Fix Visa & Credit Card Payment Issues Fast

Why Was My Card Declined on the SEAMAE Marketplace?

If your transaction was unsuccessful, it is likely due to one of the following reasons regarding international payment restrictions.

Regional Payment Restrictions

Some countries face strict limitations when it comes to global financial transactions.

- Russia: Due to current geopolitical conflicts and international sanctions, Russian-issued cards are currently blocked from most international payment networks and services.

- Other Regions: Similar restrictions may apply to several other countries due to local regulations or international banking policies.

Depending on your country, there will be different methods of payment by card.

A Message of Unity and Respect

At SEAMAE, I want you to know that you are valued, regardless of where you are from. I believe that every person is born with inherent beauty and goodness. No one has the right to label you or judge your worth based on the restrictions placed upon your country.

We are all inhabitants of the same Earth, breathing the same air. I believe we should choose love and mutual support over hatred and division. National borders should never be a reason to separate us as human beings.

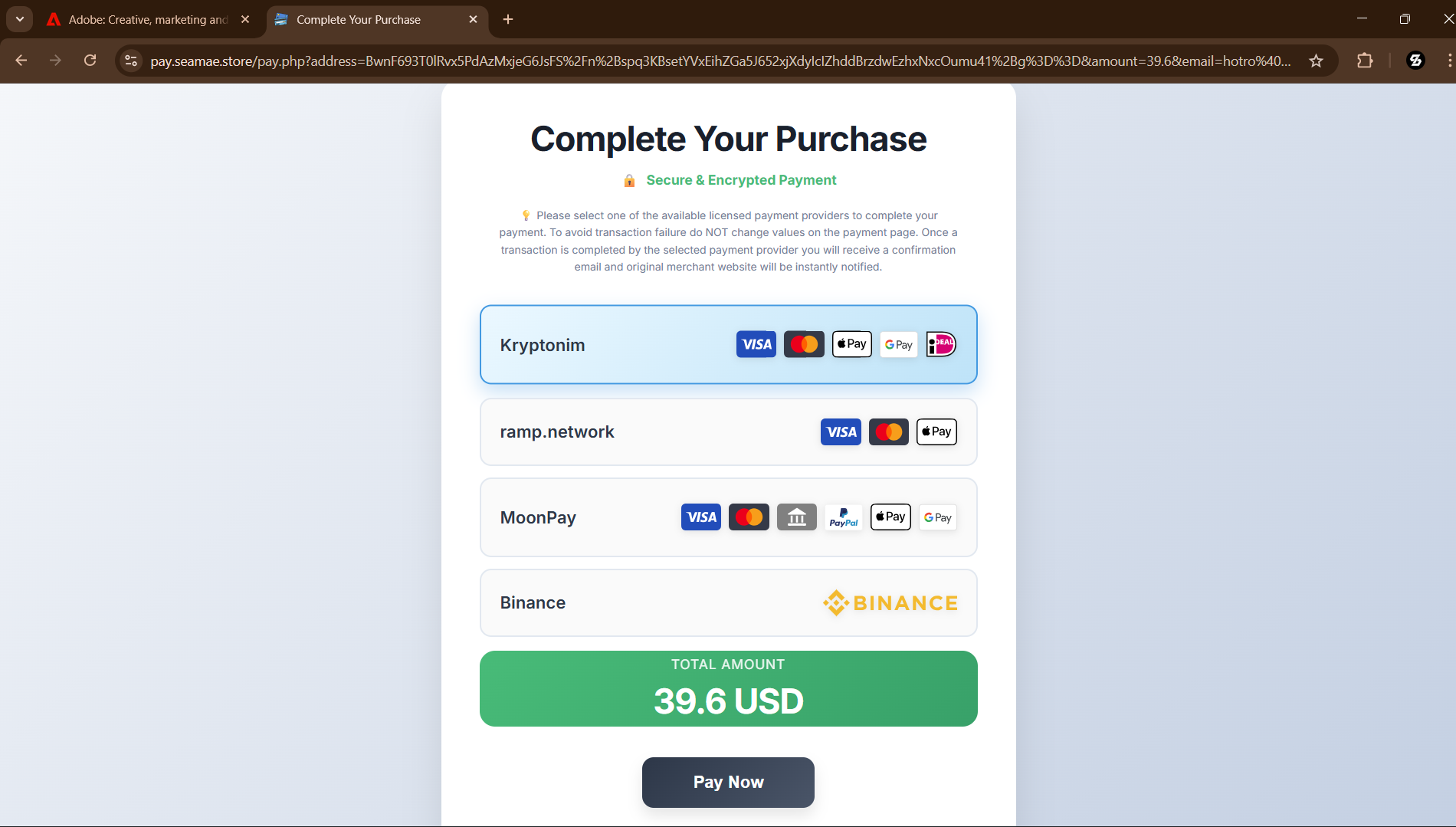

Our Solution: Cryptocurrency Payments

To ensure that everyone has access to our platform, I have integrated Cryptocurrency payment gateways. This allows me to receive payments from customers worldwide and subsequently fulfill payments to our vendors.

I understand that for those new to the digital world, Cryptocurrency can seem complex or intimidating. It involves a learning curve regarding how it works and how to use it safely.

Our Commitment to You

Thank you for choosing SEAMAE, whether you are a buyer or a seller. It is my personal philosophy and the core value of this platform to treat everyone with absolute fairness. We do not practice favoritism or discrimination.

At SEAMAE, everyone is welcome.

Modern commerce now enables consumers to acquire digital assets via peer-to-peer (P2P) marketplaces and immediately utilize them for retail purchases on platforms like seamae.store. This streamlined financial pipeline bypasses traditional banking delays by leveraging decentralized networks for both asset acquisition and final settlement. Users can transition from local fiat currency to digital liquidity through verified exchange interfaces, subsequently executing payments via encrypted wallet transfers or integrated payment gateways.

Phase I: Acquiring Digital Liquidity via P2P Marketplace

Before initiating a transaction on seamae.store, users must secure the necessary digital assets through a reputable P2P exchange, such as Binance.

- Account Configuration: Users must first establish a verified account and navigate to the “Pay” or “Funding” wallet section to initialize their financial interface.

- Navigating the Marketplace: Within the P2P trading interface, select the “Buy” option and filter by the desired cryptocurrency—typically USDT, BTC, or ETH—and the preferred local fiat currency.

- Counterparty Selection: To ensure transactional security, users should prioritize “Verified Merchants,” identifiable by a distinct yellow badge, which indicates a proven track record of reliability.

- Execution and Settlement: After entering the purchase quantity and selecting a payment method, the user must transfer the fiat funds to the seller’s designated account.

- Asset Release: Once the seller confirms receipt of the fiat payment, the digital assets are released into the user’s funding wallet, completing the acquisition phase.

Phase II: Executing Payments on Seamae.store

With a funded digital wallet, the checkout process on seamae.store utilizes blockchain technology to facilitate instantaneous, borderless transactions.

- Checkout Integration: Upon selecting products on seamae.store, users proceed to the checkout interface where they select “Cryptocurrency” as the primary payment modality.

- Gateway Interaction: The platform typically utilizes third-party processors like BitPay or Coinbase Commerce to generate a unique transaction request.

- Transaction Execution: Users facilitate the transfer by scanning the displayed QR code or manually copying the merchant’s alphanumeric wallet address into their mobile wallet application.

- Verification and Finalization: The blockchain network validates the transfer, often completing the process in seconds depending on the chosen network, such as Ripple or Ethereum.

- Real-time Liquidation: The integrated gateway may convert the cryptocurrency into local currency instantaneously, ensuring the merchant receives the exact valuation for the goods provided

Global commerce is undergoing a significant shift as approximately 20% of all online transactions are now conducted using cryptocurrencies, a fourfold increase from 2020 . Major e-commerce platforms and global retailers have integrated specialized payment gateways, such as BitPay and Coinbase Commerce, to allow consumers to pay with Bitcoin, Ethereum, and various altcoins directly at checkout. These third-party services facilitate seamless transactions by converting digital assets into local fiat currency in real-time.

The rapid adoption is driven by the maturation of blockchain infrastructure and the expansion of mobile wallet applications. Beyond consumer purchases, digital currencies are streamlining cross-border remittances—reducing transaction times from days to seconds and significantly lowering fees compared to traditional banking. Additionally, smart contracts on platforms like Ethereum are automating complex financial agreements in sectors such as real estate and supply chain management.

The Evolution of Digital Commerce: From Speculation to Utility

The transition of cryptocurrency from a speculative asset to a functional medium of exchange represents a pivotal moment in global finance. As of 2025, the infrastructure supporting these payments has matured to the point where digital assets offer tangible operational advantages over traditional systems.

One of the most impactful real-world applications is in cross-border transactions. Traditional remittance services are often bogged down by high fees and multi-day processing times. In contrast, cryptocurrencies like Ripple (XRP) were engineered specifically for efficiency, facilitating international transfers in seconds for a fraction of the cost. This is particularly transformative for expatriates sending money home or businesses engaged in international trade.

Furthermore, the rise of smart contracts has introduced a level of automation previously unattainable. In real estate, for example, escrow services can now be automated through code, releasing payments only when specific conditions are verified on the blockchain. This eliminates the need for expensive intermediaries and reduces the risk of human error or fraud. As transaction volumes on blockchain networks continue to grow at an average annual rate of 30%, the integration of these technologies into everyday commerce is no longer a future possibility, but a current reality.